If you own a business (or work in organizational leadership), you probably have some questions about ESG. Is it really new? Is it just a fad? And, most critically, is it something that matters for your company?

The answers, succinctly put, are yes, no, and definitely.

More questions? Don’t worry. We’re here to explain the what, why, and how of implementing an ESG strategy in your business—as well as why the investor community is sitting up and paying attention.

.png?width=2240&name=Why%20ESG%20Matters%20for%20Investors%20(and%20Business%20Leaders).png)

ESG, Corporate Social Responsibility, and Corporate Sustainability

Environmental, Social, and Governance (or ESG) is not the first framework to audit and evaluate organizations using the lens of social responsibility.

ESG is in many ways a direct descendant of Corporate Social Responsibility (CSR) and Corporate Sustainability (CS). CSR took hold in the US in the 1970s and famously advocated for the “triple bottom line” of people, planet, and profit, and CS became popular in the late 80s and emphasized reducing environmental harm.

Both of these frameworks have facilitated important discussion around the fact that corporations are powerful social actors, and their decisions have consequences that extend far beyond their fiscal bottom lines.

These frameworks also share critical weaknesses. CSR and CS both rely primarily on an ethical appeal to justify their existence and tend to focus on voluntary or subjective reporting measures, limitations that have ultimately prevented these programs from becoming fully embedded in operations and limited their utility for investors and organizational leadership.

What Makes ESG Different

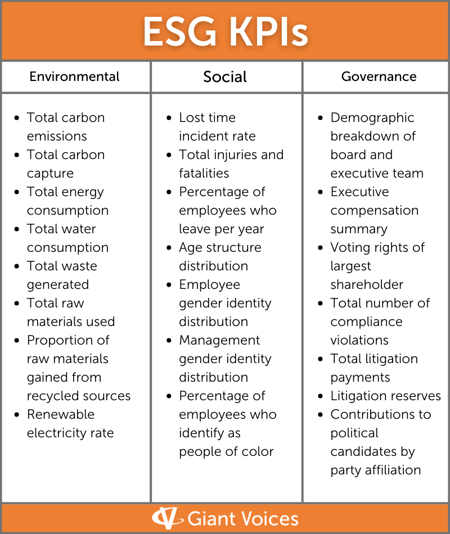

Two main things that distinguish Environmental, Social, and Governance programming from its predecessors. The first is a focus on trackable KPIs, and the second is a critical value-creation orientation.

Instead of measuring financial performance and treating non-financial performance as an amorphous and hopefully positive set of unknowns, ESG sets out to quantify and track non-financial performance metrics in order to identify strengths and opportunities and optimize across all variables.

One result of these sophistications is that ESG ratings are of particular interest to organizational leadership and investor communities. Used strategically, ESG can help evaluate the overall health of an organization and develop a roadmap for reducing risk and increasing investment returns in the long term.

ESG KPIs, Metrics & Reporting

It’s often said that we should measure what we care about. It can also be said that in many cases, we are unable to care about the things we don’t measure. Meaningful, actionable KPIs distinguish ESG from its predecessors. Because ESG is designed to address all aspects of a company’s non-financial performance, the list of metrics employed is long and should be tailored to both the industry and company in question.

Meaningful, actionable KPIs distinguish ESG from its predecessors. Because ESG is designed to address all aspects of a company’s non-financial performance, the list of metrics employed is long and should be tailored to both the industry and company in question.

Although there is no one body that officially holds the authority to conduct ESG audits or issue ratings, many major funds including MSCI, Sustainalytics, and S&P Global, have begun to publish ESG ratings that investors can use to judge their risk exposure, and companies are increasingly making disclosures in their annual report or a standalone sustainability report.

Read more about how to implement an ESG strategy (and market your efforts) here.

ESG and Value Creation

The forerunners of ESG tended to rely solely on altruistic urges to justify their existence, assuming that stakeholders share an external value like protecting the environment or raising the standard of living for employees.

This appeal to external values is not a bad thing; indeed, shared purpose (and a grounding in shared values) is a critical part of any company culture.

What previous frameworks tended to leave out, however, is that commitment to ESG initiatives is not only about a sense of responsibility or a commitment to social good—rather, attention to ESG concerns is absolutely critical for long-term institutional viability.

ESG isn’t the icing on the cake—it’s the eggs, the flour, the pan, the cook, and the oven.

Not convinced? Companies with strong ESG performance:

- Have an easier time attracting and retaining talent

- Can avoid or reduce regulatory pressures

- Are positioned for a changing energy future

- Reduce material and energy costs

- Avoid risky investments

- Are structured to reduce liability and increase resilience

Although the connection between these advantages and the bottom line is clear, ESG is the first framework to quantify these aspects of corporate performance and link them explicitly to improved long-term financial outlook.

In other words, ESG is distinguished by the understanding that environmental performance, social health, and governance structure inform and reinforce each other—and that all three have a critical effect on a company’s immediate health and long-term risk exposure.

ESG Metrics & Investors

There are many reasons for business leaders to engage an ESG framework when structuring their business operations—and it turns out that these same reasons are proving attractive to investors.

Increasingly, investors see strong ESG performance as a measurement of overall company health.

In fact, some fund managers predict that merging the world of asset management with the world of sustainability will be a huge driver in how companies build and maintain their assets moving forward, with the objective to reduce exposure to investments that pose greater ESG risks or to influence companies to become more sustainable.

This means that for business owners, the benefits of investing in ESG also include an increased ability to attract investors.

Getting Started with ESG Programming

At Giant Voices, we are experienced in helping clients facilitate discussion around ESG priorities.

We can also help you identify alignment between your business objectives and ESG offerings so that any new initiative you undertake helps you move towards your business ambitions.

Questions? We’re here to help. Just contact us to get started.